When I was in the fifth grade, the yearbook was our token congratulatory gift that symbolized we were leaving the comforts of elementary school and moving up to the exciting world of middle school. At that time, my classmates and I were asked what we wanted to be when we were 25 years old and our responses were featured. My yearbook photo was 11-year-old me still missing a few teeth and next to it read, “At 25 I will be a teacher or an actress, married, and a mom.” Little did I know I would end up working in financial services!

Reading that as someone in my 30s, I can’t help to laugh. While I am married, I have yet to accomplish those other roles. Even when I graduated from college, I couldn’t imagine myself where I am today—working in financial services for the past seven years. And maybe more surprisingly, I genuinely love it!

Admittedly, having a career in financial services is not what I would have expected. Here are four of my biggest surprises and takeaways about working in the financial services industry.

This article is sponsored by Fidelity.

1. You don’t have to be good at math

Attending a liberal arts college, I was more drawn to the humanities. I’m pretty sure I didn’t have to take a single math course throughout my undergraduate career. Rather, I enjoyed history and political science, and was even one credit away from being a music minor.

Believe it or not, none of that matters at my current job. I don’t sit at my desk crunching numbers and analyzing data. Of course, there are some roles in finance where you are doing that. But if you’re like me and that’s not your thing, there’s so much more out there!

I love collaborating with others, and I really thrive on those connections. Financial services firms often have their own in-house advertising and marketing teams, so there are many opportunities for those who are seeking opportunities to be creative. Or if you’re looking for a role that aligns with personal values, many firms have positions that are focused on community relations and charitable giving.

For me, I’ve enjoyed the opportunity to move around within Fidelity. I’ve even gotten a chance to explore a technology side that I didn’t even realize I had! A few years ago, my team worked on creating a financial literacy program focused on educating young adults on money fundamentals. I traveled to many college campuses teaching this program to students. But since I’m one person, we needed to figure out a way to scale it. As a result, my team gamified the financial literacy program so it could be accessible online – allowing us to reach and educate even more people.

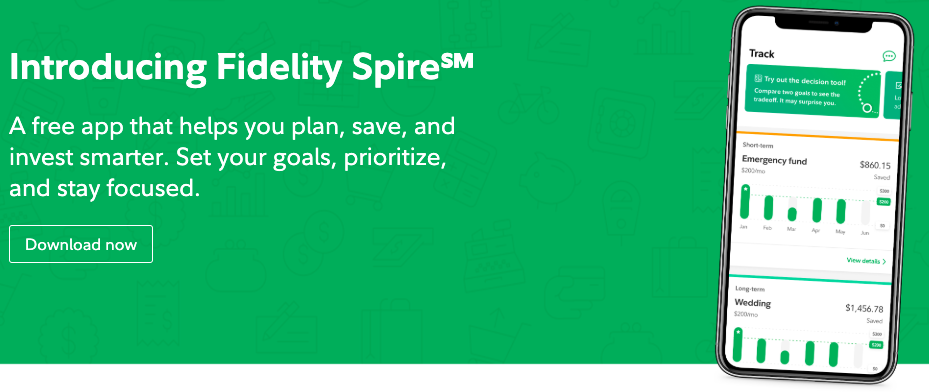

More recently, I’m so proud to have worked on launching the first new retail-focused mobile app from Fidelity in a decade: Fidelity Spire. Even when I started at this job, I never would have expected to be part of such an amazing project, building an app that is specifically designed to reach young people and help them save, invest and plan as they seek to achieve their money goals. It has been an amazing experience, and while there were certainly challenges along the way.

2. Women are excelling

If you picture someone working in finance as a man wearing a suit and tie, this is a dated generalization. Women are excelling in financial services. Our industry recognizes that there needs to be more focus on hiring, developing talent, and attracting women in these roles. At my firm, this is being done in several ways: providing support, networks, leadership opportunities, and benefits for women that help them thrive at work and in their lives.

Many firms now offer excellent training programs. When coupled with strong relationship building and communication skills, these programs provide a rock-solid career foundation. At some financial services companies, there are employee resource groups that are designed to help employees connect based on a common identity. Many have those dedicated to female employees, allowing for professional development, networking, leadership, and volunteer opportunities.

Having mentors—specifically female mentors—has helped me professionally and personally throughout my career. Thinking back to my first day at Fidelity, I met my coworker Janice who was a 30-year veteran. She seemed to know everyone, and more importantly, know everything! Janice taught me valuable life lessons that have ultimately helped guide me where I am today.

During my first week, she saw me struggle with my retirement benefits. Although this was my second job, this was the first time I was choosing to participate in my employer’s 401(k) retirement savings plan. Janice gave me an overview of a 401(k) and helped me through the process.

In the six months I worked by Janice’s side, she taught me more about finances than I had learned in my years following college. I am forever grateful for Janice guiding me in the early days of my career and I often reflect on that story when I think about my mentors and how many women have supported me and been my biggest champions.

3. You can change someone’s life

While we are not doctors saving someone’s life, we do have the chance to have a huge impact on someone’s financial stability and therefore their well-being. My relationship with money started to shift once I graduated from college and I entered the infamous “real world.” One day I had an epiphany about money—in order to travel, go out with friends, live in a place I love, I needed it!

When I started to appreciate how money impacts every aspect of my life, I started to think about a career in finance.

Instead of thinking about financial services in relation to economics, the market, and investing, I prefer to think about helping people manage their money so they can achieve their goals and live the lives they want. Who doesn’t want to help people reach their dreams?

Not many professions allow you to see the direct impact of your work, but financial services does! It is amazing to see how our work can positively impact the lives of our customers. Hearing how they were able to send their child to college with minimal student loan debt or retire comfortably.

In a way, we are part of something much bigger than our individual roles – working together we’re helping others achieve life-long goals. I love the quote, “Financial life management is about helping people live as richly as possible.” I couldn’t agree more!

4. It’s not only rewarding but also fun!

In many jobs, your coworkers become like your family. Like family, there are good times and challenging times, but I enjoy the collective team mentality and working together to complete a project. It may be surprising is how much fun you can have with them.

I’ve always embraced working in a team, as I’m from New England and practically grew up in an ice hockey rink with my two brothers. That early love for the sport led me to play in college and serving as team captain during my junior and senior years. For anyone that played sports, it is clear that the skills you learn in the rink or on the field translate to the workforce. Your level of commitment is an important trait in both worlds, as commitment is the ultimate form of dedication.

When something is important, you are willing to work harder than anyone else. You are eager to ask for feedback and advice from others in order to raise your game to the next level. In order to perform at your best, you need to put yourself in the position to do so, and you do this through preparation. The best teams that I have played on were always conditioned and the most prepared for the game ahead.

Learning to commit thorough intense preparation during my athletic career has helped me enormously as I grow my professional career, embrace change, and look at each work challenge as my next game.

As committed as we are to the work we’re doing, we also have to find time to connect with each other personally. I especially love the times we have been able to join Fidelity Cares Day, a firm-wide program that provides volunteer opportunities to support students and families with the educational foundation to attain personal and financial success. With my teams, we have volunteered to play personal finance games with kids, sort food at a food bank, and even plant seeds at a farm!

I never expected all these wonderful life experiences would come from a career in financial services. There are no yearbooks at work that commemorate my achievements and capture my future life aspirations. Instead, when I reflect on my career, I carry with me the memories from working with so many teams, all the mentors I’ve learned from, and the customers we’ve helped achieve their life goals.

And if I had to predict where I’ll be in another 10 years, it is a pretty good bet that my rap career still will not have taken off, but my hope is to still be working at Fidelity leading a team of people who are helping others live the lives they want, while still occasionally standing up in front of groups of young adults and urging them to engage more with their money.

This article is sponsored by Fidelity.

***************

Views expressed are as of the date indicated and may change based on market and other conditions. Unless otherwise noted, the opinions provided are those of the author, and not necessarily those of Fidelity Investments.

Links to third-party web sites may be shared on this page. Those sites are unaffiliated with Fidelity. Fidelity has not been involved in the preparation of the content supplied at the unaffiliated site and does not guarantee or assume any responsibility for its content.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

942644.1.0

©2020 FMR LLC. All rights reserved.

The post 4 Surprises About Working In Financial Services appeared first on Miss Millennia Magazine.

from Miss Millennia Magazine

0 Comments